UK business travel continued to grow in July, albeit at a

slower pace than seen in June, with 1.56 billion extra miles travelled 每 a 14.4

per cent month-on-month increase compared to 30.2 per cent the previous month,

according to customer data analysis by business fuel and credit card provider Allstar

Business Solutions.

The findings are from Allstar*s latest Business Barometer

Monthly Snapshot, which tracks business vehicle mileage and credit card data from

more than 50,000 companies as an economic indicator of sector recovery. The

figures are also extrapolated to the full business population based on Allstar*s

estimated UK commercial fuel market share.

According to Allstar, the upward trajectory of business

travel within the UK may have been interrupted by the start of the school summer

holidays. The education sector was the most impacted, dropping from a peak of

216 per cent growth against the April height-of-lockdown baseline in mid-July

to 159 per cent by the end of the month. Real estate, agriculture and

construction also saw minor decreases of 8 per cent, 1 per cent and 1 per cent

respectively by the end of July. Meanwhile, the arts, recreation and

entertainment sector saw a growth rate of 19 percentage points and wholesale

and retail were up 8 per cent.

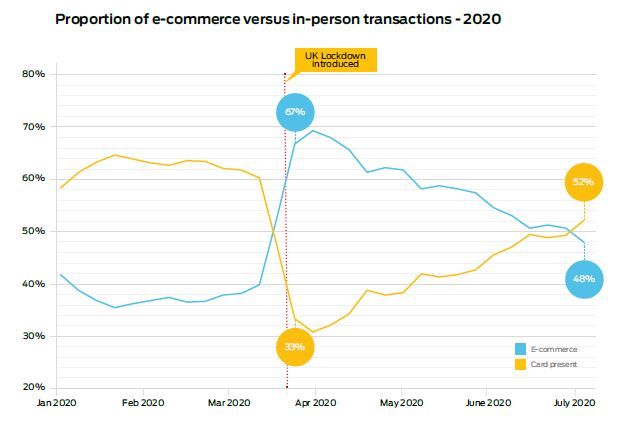

Data on credit card usage shows spend reached 82 per cent of

its Q1 average in the UK, with in-person transactions overtaking e-commerce for

the first time since the country went into lockdown in March (52 per cent

versus 48 per cent, compared to a ratio of 33/67 in

March). With the easing of restrictions and the reopening of parts of the

economy beginning in June and July, there was also a 104 per cent increase on

spend in restaurants and a 42 per cent increase at hotels.

E-commerce transactions (blue line) versus in-person transactions (yellow line). Source: Allstar Business Solutions

E-commerce transactions (blue line) versus in-person transactions (yellow line). Source: Allstar Business Solutions

Paul Holland, MD of UK fuel at Allstar*s parent company

Fleetcor, commented: ※The Bank of England predicted that the economic shock

triggered by the pandemic was less than initially feared but the bounce-back

may take longer, and this fuel consumption data appears to illustrate this. The

sectors impacted hardest by lockdown are showing signs of reactivation, albeit

with growth continuing at a steadier rate than when restrictions first began

lifting.

※It*s not surprising that the upward trajectory has been

affected by the start of the school summer holidays; this is a trend we see

from our business customers each year. And whilst it is possible that further

slowing of the recovery will continue throughout August as workers take

holidays delayed from earlier in the year, we are in uncharted territory and

the traditional seasonal downturn may be offset by the return of furloughed

employees.

※It has been interesting to see in-person credit card

transactions overtake e-commerce in July, with a significant increase in

business expenses in restaurants and hotels. We will be watching closely in

August to see if [chancellor] Rishi Sunak*s Eat Out to Help Out scheme boosts

spending among businesses in addition to consumers.§